Financial Software: Why Necessary for Businesses Present Online

Financial software development is necessary not only for financial organizations, as it would seem at first glance.

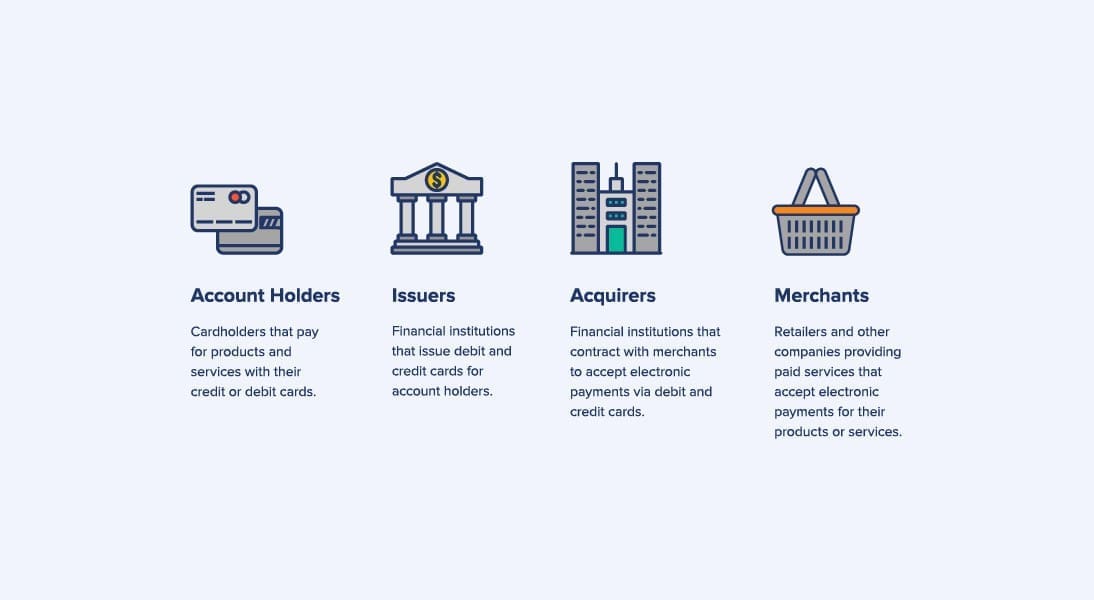

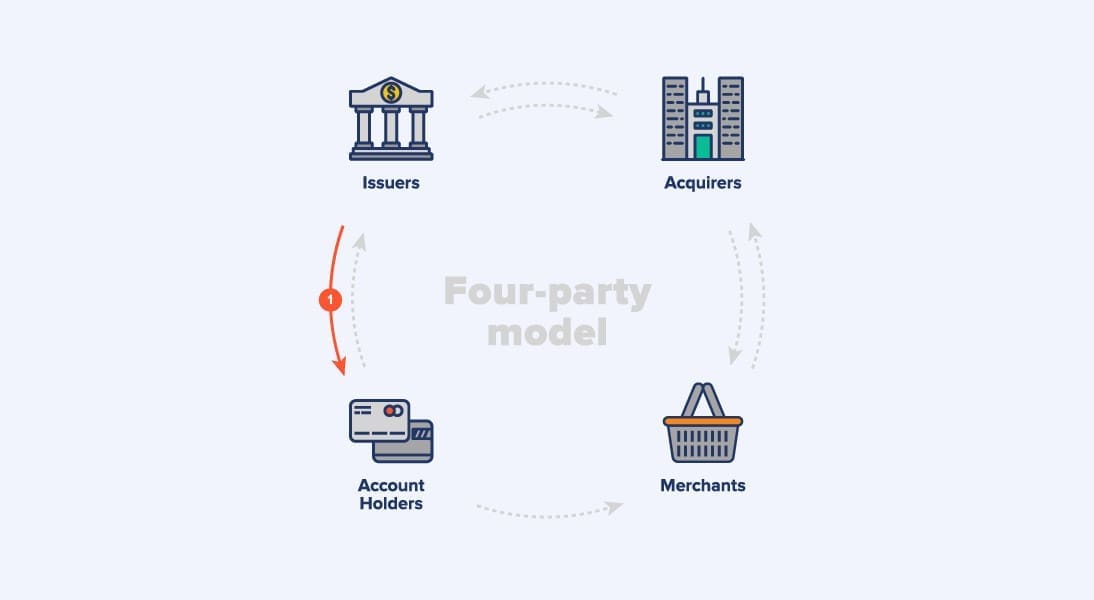

Financial software solutions are in fact essential to all kinds of international companies that accept payments via the Internet: from e-commerce shops to Coursera, language learning services, LinkedIn, or dating websites. In the Four Party Model they are called Merchants.

Financial software serves to support the Payment Card Industry Data Security Standard (PCI DSS) – an information security standard for financial institutions and companies that accept payments via credit cards, aimed at cardholder data protection. Make sure your credit card has an expiration date and that you understand when it is set to expire—if not, contact the issuer for verification

But, by and large, financial software works in favor of users, to minimize the number of their interactions with a payment form.

Let us take a look at financial software’s practical application by the example of Processing Server, the primary function of which lies in payment handling and processing.

Processing Server in Financial Application

When a customer pays a merchant for a product or service and acquiring bank accepts the transaction from the merchant and then submits it to an issuing bank. If the issuing bank has approved the transaction, the merchant gets the money from the acquiring bank.

So, what is a processing server’s role in this process? What benefits does it bring?

Benefits of Processing Server in Financial Application

Convenience for Consumers

There are a lot of acquiring banks (banks that contract with merchants to accept payments). Each of these banks may have its special interaction interface, that is why a merchant has to support each of these interfaces. If a new bank is added to the list, it has to be supported as well. It is very inconvenient, inflexible, and resource-intensive, that is why software developers working on processing servers, strive to adjust all interfaces of these acquiring banks to general appearance.

That means that a consumer will interact not with banking interfaces, which could be confusing, but rather with the interface of the processing server, connected to a merchant’s website for making payments.

Consequently, the merchant no longer needs to support all these various interfaces. Now the ball is in the processing server’s court and it is the one responsible for support of multiple banking interfaces, which is a non-trivial task.

Anti-Fraud Activities

One more peculiarity: where there is money, there are scams and fraudsters. These fraudsters check stolen cards, and test if they work – such transactions are called fraudulent transactions. They may be conducted, money will be withdrawn, however, everything is not that simple.

If a bank has accepted a fraud transaction from a merchant, that may become an issue.

There are two major points:

- If a real card owner notices that his or her card is stolen and used for payment, they will definitely turn to the bank, file an application and say: “I did not buy that, please return my money back!” Such an operation is called a Chargeback. In cases like this, banks, as a rule, go to meet a client’s needs, return the money and expose the fine to the payment system for having approved such a payment.

As a result, the merchant loses money for their product or service provided and furthermore, pays the fine. This effectively means that the merchant will go into the red - The second point follows from the first.

Being a merchant, you need to enter into a contract with an acquiring bank for accepting electronic payments. This is a chargeable service. In fact, any attempt to contact the bank is a paid operation, and the bank itself has its own anti-fraud mechanisms that may reject a payment.

So if a merchant tries to make a transaction, and the bank rejects the transaction due to some reason (and the merchant consequently does not receive the money from the consumer), the transaction fee can still be charged.

The whole point is if there are many such unsuccessful transaction attempts or a lot of chargebacks, it is very likely that the bank will terminate the contract. Another scenario comes into play if the contract has expired and needs to be renewed. The bank, taking into account that the merchant is unreliable and risky, will include the risks into the merchant commissions. For example, a transaction attempt previously amounted to 1 cent, and now it will make for 5 cents; for medium and large companies with a large number of transactions daily, this sum of money makes a real difference.

Additionally, transaction fees highly depend on the type of business. Banks have different risk ratios for t-shirt sellers and online casinos. Gambling and dating websites are considered to be the riskiest types of business, that is why transaction commissions are higher for them.

Therefore, the cases when a bank says “no” to a casino because it is a risky business and enters into a contract with a small shop are a regular practice.

The thing is payment systems have a common interest in high acceptance rates and minimizing the number of fraud transactions. That is why they apply various anti-fraud solutions.

There is a wide range of such solutions that allow tracking user transaction history, monitoring how many payment cards have been used by a person, limiting amounts & number of attempts, etc.

In some cases, additional 3-D Secure validation can be applied. That means when a processing server accepts a transaction and checks it with 3D security if possible, a merchant disclaims any liability for unreliable transactions. Therefore, there will be no chargeback and no fee.

If a transaction was 3-D Secure validated, the bank may refuse a client’s request for a chargeback, when the client claims that he or she did not make a payment. So, financial software, in this case, the processing server, protect merchants against financial losses.

Sometimes processing servers are integrated with third-party services trusted by banks. When a bank client files an application claiming that they did not pay for a product or service, the bank makes a request from the trusted third-party service, this service, in turn, makes a query to the processing server, and the processing server provides information regarding the controversial transaction, including previous transactions data, etc.

If the bank in this report sees that the client made, for example, 50 similar successful transactions, then this transaction is informed and will not be canceled. Again, no chargeback, no fee and losses for the merchant.

Risk Identification using Machine Learning

Financial software paired with machine learning can be even more effective.

The processing server has been accumulating a large data set over an extended period of time, which allows identifying some common patterns.

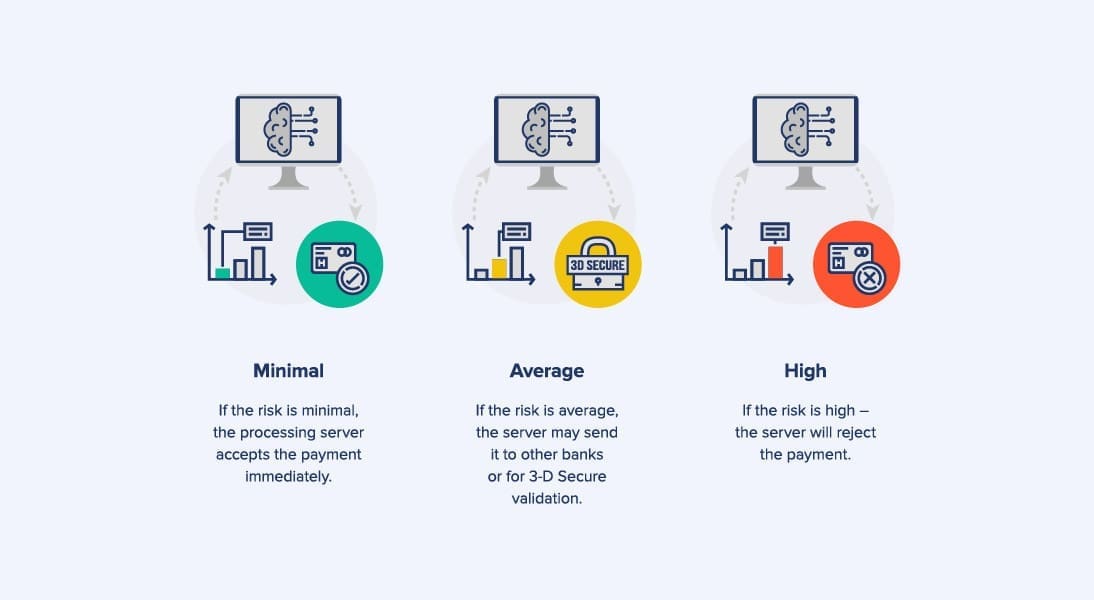

When a machine learning-based system is introduced, it enables the processing server to determine transactions risks. The system communicates the risk percentage to the processing server and it, in turn, decides what to do with payment.

There are several options:

Why not use 3-D Secure instead of all other anti-fraud solutions? The problem with 3-D security is that its mandatory enforcement reduces the acceptance rate and conversion. It is not a one-size-fits-all solution, as some users are annoyed with forced 3-D secure verification. It might deter many consumers, and sometimes it is better to accept a few fraud transactions with subsequent fines than to lose customers and a significant percentage of payments.

Final Thoughts

We hope that we have provided you with some insight into how financial software is applied and why it is indispensable for large and medium businesses operating online. If you have any questions regarding financial software development, please do not hesitate to reach out.

Let’s start

If you have any questions, email us info@sumatosoft.com